Marketing Department Budget Sample and Template PDF (Free)

A budget is one of the first steps to getting your marketing department strategy in order. In fact, realized or […]

Read More »Become a successful marketing consultant: Learn more

The rate at which prices of goods and services rise is called inflation.

Inflation simply means you need more money to buy the same things.

But not all inflation is the same.

And inflation will impact segments of the market differently based on what kind it is. You need to know the difference between cost-push inflation and demand-pull inflation, and that is the purpose of this article.

There is a huge difference between cost push inflation and demand pull inflation. Cost push inflation is caused by the supply side, i.e., the cost of product inputs increase the product or service price. Demand pull inflation is caused by the buyer, , i.e., too many buyers chasing the same product.

There are two forms of inflation depending on supply and demand. These are cost push inflation and demand pull inflation.

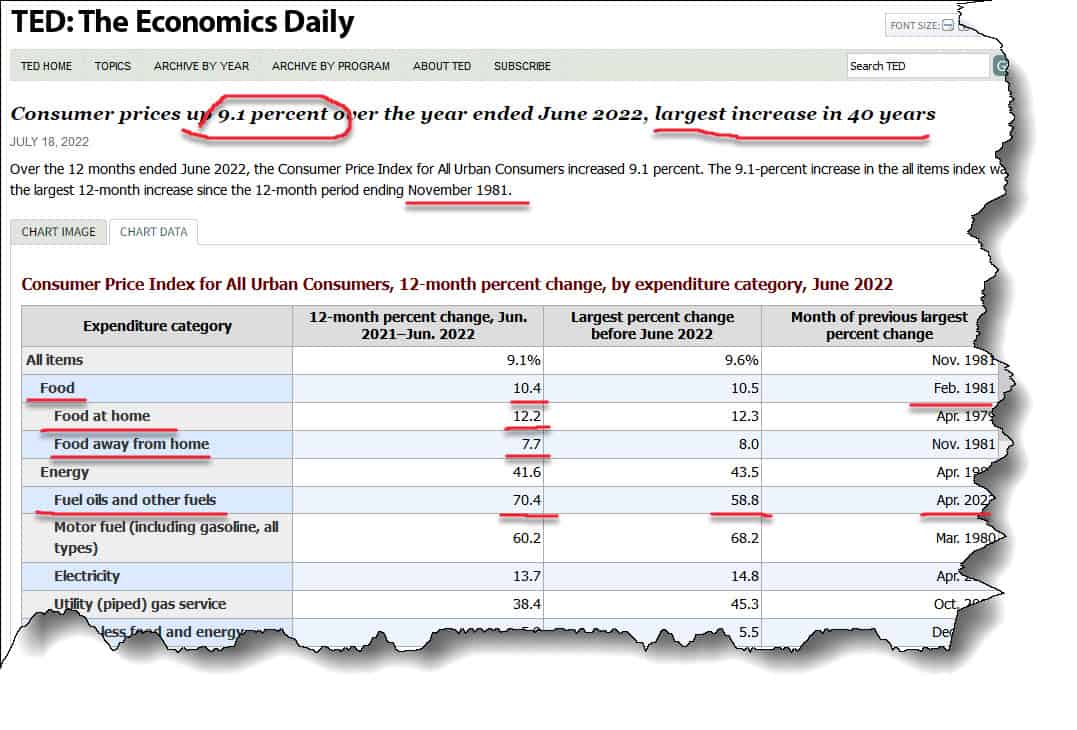

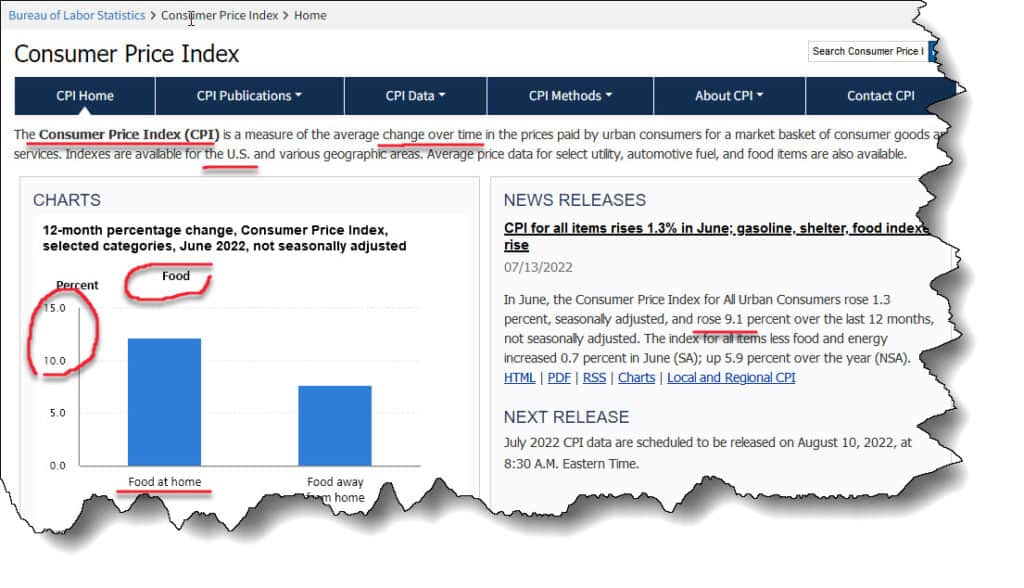

For example, in this recent excerpt taken from the Bureau of Labor Statistics (BLS) reporting the Consumer Price Index, ‘food at home’ prices increased over 12%, year over year.

You have to ask yourself:

The answer to this important question will be come clear to you in this article.

While the answer could be a combination of both factors, something specific usually triggers sharp inflation.

Let’s now explore this so you know how to identify it, how it affects your customers buying habits, and how you can modify your marketing strategy as needed.

Cost-push inflation is a dramatic hike in the price of goods and services caused by limited supply.

We call it cost-push inflation when you have to buy things such as labor, raw materials, and land at unusually high prices.

The total cost of goods and services can increase because it is becoming expensive to produce them.

Here is an example:

Suppose you have an employee you pay $20 to make bread worth $25. Then the employee decides to charge $30 or move to a better-paying company. You must pay the amount because you cannot find another employee if this one goes. But the increase will hurt your profits, so you transfer that to the customer and charge $35 for the same bread.

Another example that hits home at the time of this writing is the global shortage of fertilizer, specifically nitrogen.

A raw material and supply-side product input, nitrogen is extremely important for the production of our food supply. Local farmers and food producers rely on fertilizer in order to produce food. And as you know, besides energy, there is nothing more important than the food supply.

But something contributes to a disruption in the supply and demand, and here is an example of a disruption of the nitrogen supply chain. A decrease in the production of fertilizer -- specifically nitrogen -- is directly leading to a rise in the cost of food.

But prices don’t just magically rise without a reason.

In this case, the delivery of a key ingredient in the production of fertilizers, potash, has been disrupted.

Simply having a train derail may not have such an impact on the supply chain, but in this case it might be a contributing factor.

Events such as this disruption in the product supply chain, has directly impacted the price of food, and is a classic example of cost push inflation.

But, again, cost push inflation doesn't just magically happen. Something usually sparks it.

Here is a USNews.com report featuring Russia, who alongside Canada are the worlds top producer's of potash for fertilizer.

A Russian spokesperson said they want to fulfill their potash orders, but say they had sanctions placed against them which disrupts the food supply.

Additionally, it looks like the United Nations reversed their sanctions on Russia so they can now ship the fertilizer to their world trading partners. It also looks like the UN knows that their sanctions have disrupted the food supply and caused cost push inflation. It further appears that the UN is trying to reverse their actions and they are trying to encourage free trade once again.

These Government officials virtually stopped the sale of an important food product input: potash. This limited the supply of potash and caused a decreased supply of fertilizer, which caused a limited supply of food production, which caused 'food at home prices' to increase more than 12% year over year.

For more about this, be sure to read: What is Free Enterprise in Marketing? (Answered!).

This is a classic example of cost push inflation caused by government who either didn't know what they were doing or directly wanted to disrupt the supply chain.

Two leading causes of cost push inflation include:

Scarcity of raw materials can cause this form of inflation. Raw materials are things used to produce other things. For instance, you need flour to make bread. If baking flour becomes scarce, the few sellers who have it may sell at a price two times more than usual. The baker will transfer the extra cost to the buyers. You now have less money to buy bread.

And in the above real world example, you need nitrogen and fertilizer to produce food. When those costs rise, so do food costs.

Inflation here occurs when you have to pay higher salaries to workers. This happens because they are few, and employers have to bid for them. Or, the labor unions have demanded higher salaries from the employers. Since the production of goods and services will stop if you lose employees, you increase the salaries and charge the customers more money for the same stuff.

Please note that it is the supply that changes, not the demand. For cost push inflation to happen, the demand stays constant, but the sellers have fewer products to satisfy everyone. The sellers gradually charge more, and few people can now afford to buy those products.

Demand pull inflation largely differs from cost push inflation. It results from more demand in areas of the economy, including:

Here is the perfect example. Suppose you go buy a scooter which normally costs $799. However, three other people want the same scooter. They have to outbid you. The first quotes $830, the second $880, and the third says she will buy it at $900.

Since you don't want to lose, you buy the scooter for $1000.

Demand pull inflation behaves like an auction.

Unlike the cost push inflation, the buyers increase the prices themselves. The bidding up causes inflation. In other words, there is too much money to buy very few products. Demand pull inflation sometimes happens in growing economies.

This literally means that customers have too much money available in the money supply. Several things can excessively increase the money supply in the country. These include:

Government spending increases the amount of money in citizens' hands. It allows people to get more cash. The citizens now have more money to spend, but the goods in the market remain the same.

Prices go up. In this case, your marketing campaign is usually easy to fund and the market is often willing and able to spend more money on product and services as a result of a superior marketing plan.

Assets are valuable things like securities, houses, land, and cars. For instance, the amount of land remains constant, but there are plenty of buyers every day.

Who will you sell your land to?

Of course, the person that pays more cash than the others. Certain assets experience periods of high demand which attracts hiked prices.

Inflation happens when the government prints new money when it cannot make enough money through business activities and taxes to pay debts.

The excess money finally goes into circulation, creating an oversupply. The same happens when banks lend money to too many people.

The currency you use can lose its value compared to a stronger currency. For instance, the US Dollar can become weak compared with the Euro. This raises the price of imported goods if the US buys stuff from Germany, Italy or Hungary. This situation can cause a significant increase in the prices of imports.

Cost-push inflation is caused by a shortage in availability of labor and raw materials. The sellers hike prices.

Buyers are responsible for demand-pull inflation. They have too many dollars trying to buy very few products. Therefore, buyers hike the prices while outbidding each other.

Know the difference between cost push inflation and demand inflation and how it affects your target market, and your sales forecasting and your marketing strategy and campaigns can become much more effective.