How to Sell Food Online (7 Steps)

If you have ever wondered how to sell food online, this is the article for you! That’s because in this […]

Read More »Become a successful marketing consultant: Learn more

Do you need a loan to start a business? Looking at the best type of loan options for your start-up?

If you have ever wondered what type of loan is best for starting a business, you have found the right place.

The best type of loans for starting a business with no money are: 1. Business credit cards, 2. SBA 7(a) loan, 3. SBA microloan, 4. Online term loans, 5. Personal loan, used for starting your business.

While we won’t be discussing the nitty gritty components of the cost of a loan for starting a business, we will explore multiple types of loan options that you can use to fund your business or startup.

For more info on what higher interest rates really mean for financing the growth of your business, please go here:

What Higher Interest Rates Mean for Marketing Your Business (9 ways)

Let’s get started.

There are many business loan options available because banks want to loan you capital. It’s how they make money.

The main factor for you is determining how much this will cost you to borrow money to start a business.

This is known as the ‘cost of capital’. A fantastic topic for a later discussion.

On the other hand, the main factor for the bank is minimizing their risk in lending money for starting a business.

After all, a loan for starting a business has many moving parts. You need funding for inventory, rent, operating capital, building your sales funnel, real estate, advertising, and if you have a big vision of going global you might even want some funds for international marketing. But banks aren’t always willing to loan money to a start up, mostly because there is no track record of sales revenue, profit and free cash flow to repay the bank.

Let’s now look at the 5 best types of loans for starting a business.

Probably the easiest option to finance your new business is through a business credit card(s). Suppose you don't have a business credit history. In that case, you can use your personal credit history to get a business credit card.

If you have a score above 690, you can generally qualify solely based on your credit history.

There are multiple other requirements to apply for a business credit card, such as tax ID number, business name, legal structure, address and phone number, and annual revenue of the business (If this is 0, then it's usually not a problem).

Using a personal credit card or a business credit card is a frequent way of getting access to capital for starting a business. This is an easy way to get started and not spend too much money upfront.

But it's not without risk—if you're not careful about how much credit card debt you take, it can quickly spiral out of control. You need to have a clear focus on sales revenue from your new business.

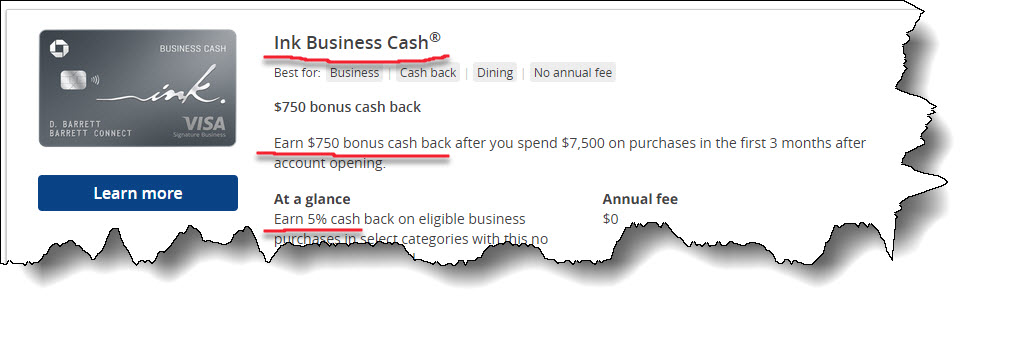

We prefer the Ink Business Credit Card by Chase as the points do rack up pretty quick, and they have good spending categories.

Another option is the Discover card. They have incredibly good customer service and probably the best user admin in the business. They also probably have the best security and credit monitoring service of any credit card platform on the market.

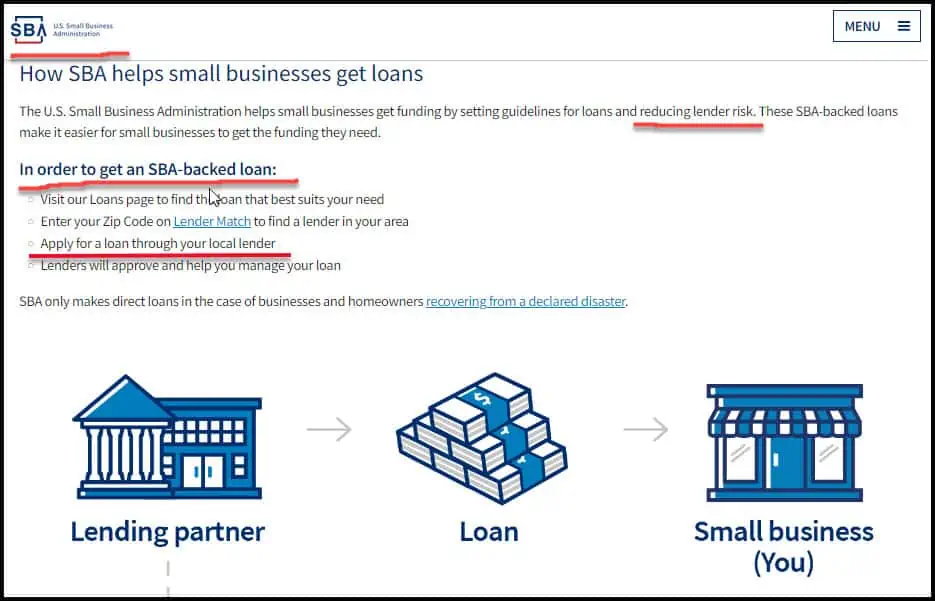

An SBA 7(a) loan is the most standard type of loan that SBA offers. You can use this loan for a variety of purposes, such as purchasing real estate properties, equipment, inventory, and for additional working capital which may be used to fund marketing and growth strategies.

Depending upon the size and the Key Performance Indicators (KPIs) such projected sales revenue, gross profits, net income and the cost to acquire a customer in your niche market, this option may not be best for you as interest rates on a 7(a) are very high compared to other options.

Here are some sample SBA 7(a) loan options (these could change at anytime):

| Loan Amount | $30,000 to $5 million |

| Term length | Up to 25 years |

| Interest rate (loan amount less than $50,000) | 11.25% (As per July, 2022) |

| Interest rate (loan amount more than $50,000) | 9.25% (As per July, 2022) |

An SBA microloan is one of the best and most affordable small business loans targeted explicitly toward startups. You can get up to $50,000 to grow or start your business.

SBA microloans are focused on reaching lower-income communities and businesses that traditional lenders often ignore. If you fall in this category, an SBA microloan might be a serious option. Here are some sample SBA microloan options (these could change at anytime):

| Amount | Up to $50,000 |

| Term length | Maximum 6 to 7 years |

| Interest rate | 6% to 9% (8.5% as per July, 2022) |

| Fee | Up to 3% of the loan amount |

Online term loans are generally available through online lenders and traditional banks. However, banks require more documentation and qualification than online lenders.

The maximum loan you can get from this option seems to fall between $250,000 to $500,000, but startups will generally not qualify for an amount this high. In addition, online lenders generally require the startup to be operational for at least six months to 1 year before it can be considered for a loan.

You can also take a personal loan instead of a business loan to start a new business. Personal loans are easier to qualify for than business loans if the business has limited or no history. In addition, the application and approval process of a personal loan is less rigorous than business loans, and you may also be able to access a lower interest rate compared to some business loans.

However, there are a few drawbacks of personal loans that are

Sofi has an excellent program that you can

Here is the comparison between different lenders of personal business loans so you can choose accordingly:

| Lender | Est APR | Loan amount | Min credit score |

| Best Egg | 5.99-35.99% | $2,000-$50,000 | 600 |

| Upgrade | 6.95-35.97% | $1,000-$50,000 | 560 |

| SoFi | 7.99-22.73% | $5,000-$100,000 | 680 |

| Discover personal loans | 5.99-24.99% | $2,500-$35,000 | 720 |

| Upstart | 5.42-35.99% | $1,000-$50,000 | None |

Since you are just starting your business, you probably don’t have revenue yet, right? Well, can you still get a business loan with no business revenue?

Getting a loan with no history of sales is a matter of risk vs reward for the bank. If the risk of loaning money to a startup with zero sales and no free cash flow is bigger than the reward to the bank, the chances of getting a loan are almost zero.

Generally, getting a loan from traditional lenders is very hard when you have no revenue, no collateral, or even experiencing negative cash flows. This is because there is a high chance that your business might not create enough sales revenue and free cash flow, and you will not be able to repay the lender.

You might be able to qualify for a loan If you show the potential lender a detailed explanation of your business plan, marketing strategy, financial projections such as your revenue, expenses and income. This is called a pro forma.

In addition to this you will have to show them some sales forecasting projections, financial ratios for the numbers you have estimated such as net profit margin ratio, Asset turnover ratio, current ratio and debt ratio.

While this sounds like a lot of work, any accountant or experienced MBA can help you prepare these documents and organize something that makes sense for the lenders.

The lender will compare your ratios to other businesses in the industry and can make some educated assessments, and whether their risk is low enough based upon the information given.

To be highly successful in finding the best loan for starting your business, the process literally takes a lot of work. including: market research, sales planning, sales forecasting, inventory forecasting, market analysis and most importantly, market testing.

After you do all this, you might find that you don’t need a business loan to start your business after all!

You can do it all through sweat equity and gaining free cash flow as you make sales.

Once you have done that, banks will be beating down your door asking you to borrow money from them!

You can do it!

References:

SBA 7(a) Loans vs. SBA Microloans: How to Decide - Fora Financial Blog

SBA Microloans: What Businesses Qualify and How to Apply - NerdWallet

Best Startup Business Loans Of August 2022 – Forbes Advisor

Getting a Credit Card for a New Business or Startup - NerdWallet