How Can Manufacturing Companies Increase Sales? (Action plan)

In an effort to increase sales, companies implement marketing strategies such as creating new advertisements and selling more to existing […]

Read More »Become a successful marketing consultant: Learn more

If you would like to learn how to finance your marketing campaign for business growth, you have come to the right place.

Knowing how to finance your marketing campaign in order to reach your growth plans can be a challenge for many businesses. Here are 7 common ways to finance a marketing campaign.

There are multiple ways to finance a marketing campaign. While the best way is to fund your marketing campaign from your profits, you can finance your marketing campaign these 7 ways: 1) Conventional term loan, 2) Business credit card, 3) Business line of credit, 4) Business micro loan, 5) Online business loans, 6) Revenue-based funding, 7) Peer to peer loans.

Most great marketers agree against increasing debt to pay for a market test, i.e., paying for a $10,000 newspaper ad on your credit card at 19% interest, without the profits to pay this in full.

But, if you have thoroughly tested this marketing campaign and you already know you will gain enough sales to at least pay for the cost of the ad based on marketing data gained from previous tests, using a debt instrument to pay for your marketing campaign is a popular strategy.

If you own or manage a well-established business and your marketing strategy requires significant funding, a business term loan may be the right choice. A business term loan comes with considerable long-term responsibility but can afford you access to hundreds of thousands of dollars at competitive interest rates.

Note that business loan lenders will often require that you have been in business for a significant amount of time and you have good credit. Business loan lenders include banks and credit unions. If you opt for the business term loan route, ensure that the benefits of your marketing campaign outweigh the loan costs.

As a business owner, you can access various benefits by opening a business credit card. Whether you already own an active business credit card or seek to open a new card to finance your marketing campaigns, this financial instrument is a viable way to pay for your marketing campaign expenses.

These expenses may include recurring expenses such as email marketing, Google search ads, pay-per-click (PPC) advertisements, and social media analytics, as well as one-off marketing expenses like launching video campaigns.

Some of the best business credit cards you can use for your marketing campaigns include the various American Express business credit cards and Ink Business Preferred Credit Card. We prefer the Ink Business Credit Card by Chase as the points do rack up pretty quick, and they have good spending categories.

A business line of credit works like a credit card. A line of credit affords you a predetermined pool of capital that you can access as necessary for your business. One of the main benefits of a line of credit as a financing option is that you only incur interest on the funds you use.

Further, you can access various lines of credit products even if you have less than stellar credit or your business hasn’t been operational for a long period. Also, so long as you pay back what you draw by the stipulated deadlines, you can access the funds as long as your business needs financing.

Overall, a business line of credit offers many advantages that you can leverage for your marketing needs whenever you have cash flow challenges or want to make the most out of new business opportunities.

If you have a well-formulated and planned marketing strategy that requires more than the offerings of a business credit card or line of credit, you may consider funding it with a microloan.

A business microloan is a great option, especially when your business has a positive cash flow with increasing revenue. Typically, business microloans can range from a few hundred dollars to thousands of dollars and sometimes necessitate a personal guarantee or collateral.

A microloan may be advantageous over a conventional term loan since it doesn’t require a very large investment. As a small business owner, a microloan may be the ideal option for your marketing needs. Numerous micro-lending vendors cater to startups and small businesses that seek smaller loan amounts.

If your business is low or lacking in marketing capital, you can apply for a working capital loan online. There are several advantages of using this financing avenue, aside from the online application aspect. Online business loans are more flexible and are processed much faster compared to traditional business loans from banks and credit unions.

Depending on the lender, you can access marketing funds in as little as 24 hours if approved. Online lenders also provide loan options if you have poor business credit, albeit with high-interest rates. Nonetheless, if you can make timely payments, online business loans can help you market and grow your business.

Using your business to fund your marketing is the ideal method for financing your marketing campaigns.

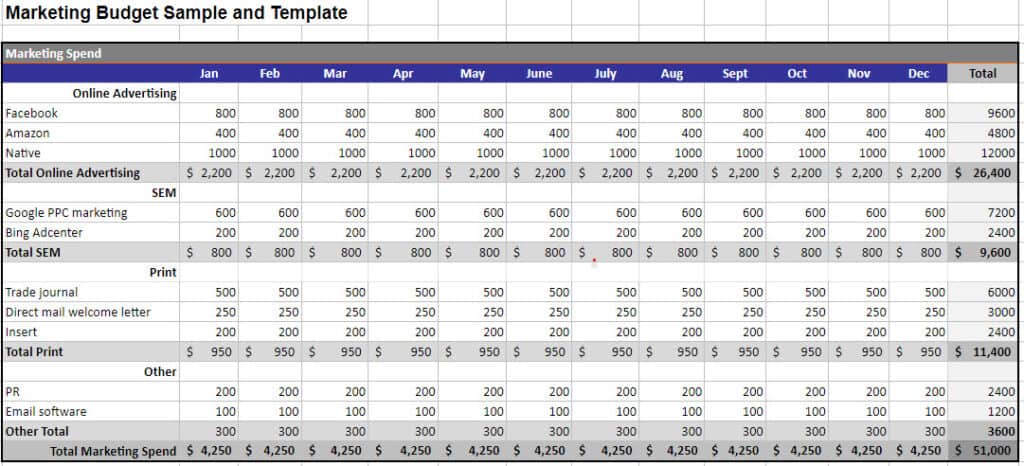

Ideally, the best option is to craft your marketing budget based on last year's sales, set your growth goals and allocate your new budget for the year. Go here to learn how to create your budget, and for a free marketing budget sample and template.

Revenue-based funding is a viable financing option when you find it difficult to access loans. If your business is already generating enough revenue and profit to cover the marketing expenses, this is the preferred model.

While this type carries one of the highest interest rates, peer-to-peer (P2P) loans enable you to fund your marketing campaign without dealing with conventional financial institutions. With this financing model, you apply for a business loan through P2P platforms such as Lending Club, Peerform, Prosper, and Funding Circle. These platforms match you with potential investors looking to lend your funds depending on your business needs.

With most P2P loan platforms, you can indicate the amount you seek to borrow, determine the duration of the loan, assess the interest rates, and view your qualification status. Generally, the amount you can borrow will depend on the specific platform and your credit history.

As you know, marketing is an essential business function and is pivotal to the growth of any business. An effective marketing campaign involves a tight focus on the right consumers.

You can do it! And if you need assistance along the way, we are happy to help!