How Do I Request Survey Participation in an Email? (Free template)

So, you’ve been given a list of customers to email and it’s up to you to ask them to fill […]

Read More »Become a successful marketing consultant: Learn more

If you have ever asked, “What’s the point of having an LLC?” you have come to the right place.

In this article we will provide information and point you to some very reputable tools to help you answer this question and then list some of the pros and cons of an LLC.

The point of having an LLC is to create a business entity that gives protection against personal liability, provides options for obtaining credit, has flexibility for management and ownership, is easy to form and provides for flexible taxation.

When starting your company, one of the most important decisions you will make is its structure. Your company structure supports your decisions in daily operations, taxes, and the level of risk of your assets.

Let’s now review some important items about the purpose of having an LLC.

As we get started in explaining what an LLC is, there is a very interesting argument that could support the idea that the Limited Liability business structure dramatically improved poverty rates.

Experts generally agree that the limited liability framework started in the 1800's. Historically, poverty rates have been well over 80% and started to improve in the 1800’s.

But even better, the industrial revolution within a free enterprise framework led to millions of people to engage in business opportunities.

This supported the need for people to reduce personal risk which led to an increase in people taking business risks and ultimately led to an increase in the production of goods and services, further decreasing poverty rates.

Additionally, this literally helped remove the archaic idea of the debtors prison. Justice.gov reports that from the late 1600's to the early 1800's, many cities and states operated real “debtors’ prisons.” These were actual jails designed for jailing borrowers – some of whom owed no more than 60 cents. These dungeons, such as Walnut Street Debtors’ Prison in Philadelphia was modeled after debtors’ prisons in London. This is where the term, "in the clink" came from.

Onward to some good news about LLCs.

Much later, America’s first LLC started in Wyoming in 1977. And today there are over 21 million LLC’s that have been formed.

Most people assume that an LLC stands for Limited Liability Corporation, but LLC stands for Limited Liability Company.

The general point of an LLC is a business structure that balances your benefits and legal protections.

When used properly, an LLC is a business entity that provides protection against personal liability. This is similar in how a corporation may provide protection against personal liability.

The owners of an LLC are called members.

Most states have no ownership restriction on LLCs. This means that anyone can become a member, including foreigners, other LLCs, corporations, and individuals. However, some business entities like insurance companies and banks cannot form an LLC.

To form an LLC, you must file Articles of Organization with the state.

These establish the powers, rights, duties, liabilities, and obligations of all LLC members. They also include the addresses and names of the members, the company’s statement of purpose, and the company’s registered agent.

In The Tax & Legal Playbook by Mark J. Kohler, CPA & Attorney he reports that in order to have a proper formation of documents for an LLC, you need these 5 documents:

Nonetheless, running and forming an LLC needs less paperwork than a corporation.

For some interesting reading and helpful information, here is a list of recent legal cases involving LLCs, produced by Baylor University:

Recent Cases Involving Limited Liability Companies

Below are some pros and cons of settling on an LLC as your company’s structure.

The below information is not legal nor is it financial advice and it is not tax advice. This information is for educational purposes in an attempt to give you some information so you can ask your attorney and CPA better questions.

For a helpful tool produced by the IRS, here is their checklist for starting a business.

Let’s get started.

Most investors will settle for an LLC because it separates their personal assets from the company. If you default on a business loan or your company is sued for any reason, your home, savings, car, and other personal assets will be protected.

This is crucial because sometimes, even seemingly safe and wise business decisions can go wrong. It assures you that nobody will seize your personal assets at this time.

However, there is an exception to using your personal assets to pay off an LLC’s loan. When you sign a personal guarantee to finance your company, a creditor can hold you responsible for a debt’s repayment and seize your assets. Moreover, you can be personally sued if there is evidence of negligence or fraud that causes harm to the other parties in a lawsuit.

With an LLC, you have several options on how you will pay taxes. This is not tax advice as it only educational ideas to help you get an idea so you can have a better conversation with your CPA or tax attorney. Here are the four tax designations you might have with an LLC:

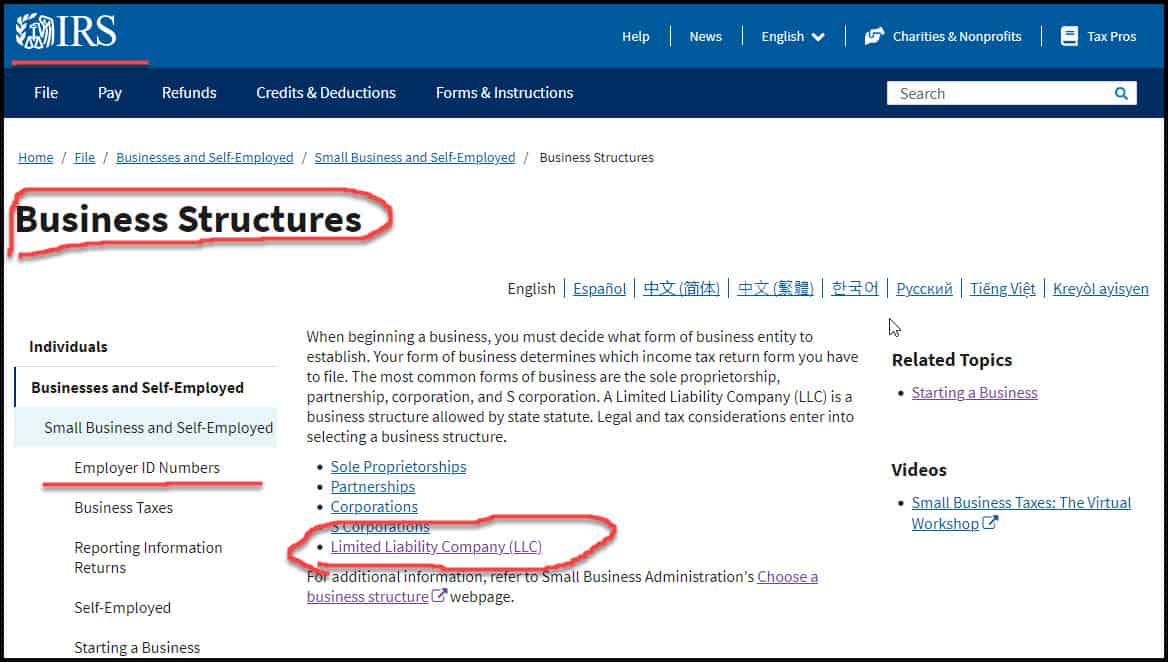

For more information about LLC’s and tax classifications, you should visit the Internal Revenue Service (IRS) here.

In many places, starting an LLC can be very inexpensive (often below $1000) and often quite easy. The paperwork is often minimal though this may depend on your state. You will typically fill out a short formation document and then submit an operating agreement and articles of organization.

Templates for these documents can be found online through reputable sources, so this may present an easier option if you are clear on what you are doing. Furthermore, unlike a corporation, you generally do not have to hold shareholder meetings annually, nor file an annual report.

Here is a helpful resource from the Small Business Administration about a variety of options for choosing a business structure.

In an LLC, members determine how to share their profits according to terms outlined in their operating agreement.

This is unlike a general partnership where profits are split equally. As such, if one member puts in more work or invests more money in an LLC, he/she can get higher profits. In addition, there exists no ceiling on the number of members an LLC can have and no requirement for a governing body such as a board of directors.

For a very helpful list of IRS approved strategies for managing and operating your business, go here: Operating a Business.

Despite the many advantages of structuring your company as an LLC, here are some of the drawbacks of this structure:

It will generally cost you more to create and operate an LLC than have a partnership or be a sole proprietor. This includes filing fees, an operating agreement, and annual state taxes and fees.

An LLC may not be ideal for a business that seeks outside investors, such as funding from venture capitalists. This is because it may be more complicated for an investor to receive ownership interests unlike when dealing with corporation stock. Consult with your attorney or CPA on how to best structure this.

In an LLC, employees who receive fringe benefits like medical reimbursement plans, parking, group insurance, and medical insurance might treat these as taxable income, thus possibly lowering the benefits’ amount. It is best to consult with your CPA on how to structure this.

If a member of an LLC dies, leaves, or goes bankrupt, the company is dissolved, with the remaining members held responsible for outstanding financial and legal obligations needed before terminating the company. It is best to consult with an attorney on how to best structure this.

Running a successful company takes more than simply finding clients and selling products.

Understanding how your business structure will affect your profits, investors, benefits, and taxes is crucial.

From the above information, you can now confidently choose an LLC if this best suits your business vision.

References: