How Manufacturing Benefits the US Economy and Why This is Important

Manufacturing plays an absolutely crucial role in every economy. This is especially true for the United States (USA) economy, largely […]

Read More »Become a successful marketing consultant: Learn more

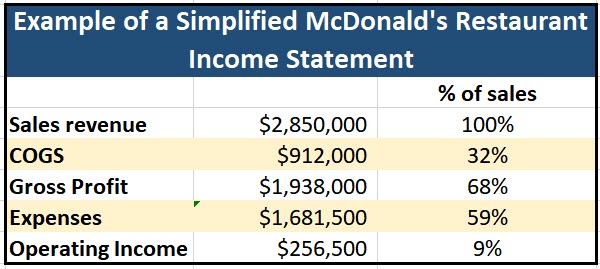

Cash flow and budgeting for food costs are essential for any food business.

In this article we explain what you need to know about cash flow and budgeting, list the 5 essential tools you need and then provide an example of how the best in the food business manages their cash flow and budgets.

How can I best manage my cash flow and budget for food costs?

To manage cash flow, a food business must track all income and expenses. A budget should be established for each product offered, including the cost of ingredients, labor, packaging, and other overhead costs.

Managing cash flow and budgeting for food costs can be a difficult task, but if done properly, can help improve a food business’s overall profitability and success.

Let’s get started.

Said simply, cash flow is the amount of money that is coming into and going out of a business.

Managing cash flow includes:

By tracking this information, the business can identify areas where cash flow may be lagging or where it may need to be improved.

A budget should be established for each product or service that the business offers.

This budget should include the:

The budget should also take into account any discounts or promotions that the business may offer.

By budgeting for food costs, the business can ensure that it is not spending more money than it is bringing in.

McDonald’s has been a leader in the food industry for decades and has managed its finances in a very successful manner. Every McDonald’s location is taught to keep a close eye on its cash flow, using a reliable system to track the amount of money coming in and going out on a regular basis.

Not much else is more important than cash flow to a food business.

You must be able to anticipate the cash needs of the business, anticipate changes in the cash flow, and analyze the financial data to make sound decisions about cash flow management.

This budget should include all of the expected income and expenses for the business. The budget should be updated on a regular basis to ensure that it remains accurate and up-to-date.

Once the budget is created, analyze the data to determine the best way to manage the cash flow of the business. This analysis should include looking at the cash flow trends over time, such as the average amount of money coming into the business and the average amount going out based on time of year, peaks and valleys and if there is any changes to the cash flow based on seasonality (i.e.New year, holidays, summer, winter, etc).

The business should also look at the cash flow projections for the business in the near future and determine the best way to manage the cash flow in light of these projections.

This system should include a record of all of the cash coming into and out of the business.

This record should be updated on a regular basis so that the accountant can track the current cash flow of the business. This system should also include a record of all of the payments made by the business, including:

You need to analyze the data to determine how the cash flow is being used and how it can be improved.

You should look at the trends in the cash flow over time and identify any areas where the cash flow can be improved. You should also look at the budget to determine if there are any changes that need to be made in order to better manage the cash flow of the business.

This strategy should include the steps that need to be taken in order to improve the cash flow of the business.

These steps may include:

This system should include regularly scheduled reports that track the current cash flow of the business. This system should also include a way to set up alerts when there are changes in the cash flow that need to be addressed.

By following these steps, an accountant can effectively manage the cash flow of a food business.

A good food business should be proactive in analyzing the data, setting up a budget, and creating a strategy for managing the cash flow.

By following these five steps, you can ensure that the business’ finances are managed in an efficient and effective manner.

For more helpful tools and resources, visit this library of articles: