What is the Customer Intimacy Strategy? (+9 Strategies)

Companies that choose the customer intimacy strategy are communicating to their customers, “Choose us because we can customize our products […]

Read More »Become a successful marketing consultant: Learn more

A business is often filled with excitement, enthusiasm, and optimism.

However, it becomes harder to achieve goals without a well-thought-out plan.

And core to this plan is a budget. Without a budget, a business can often become rather aimless lacking a proper structure.

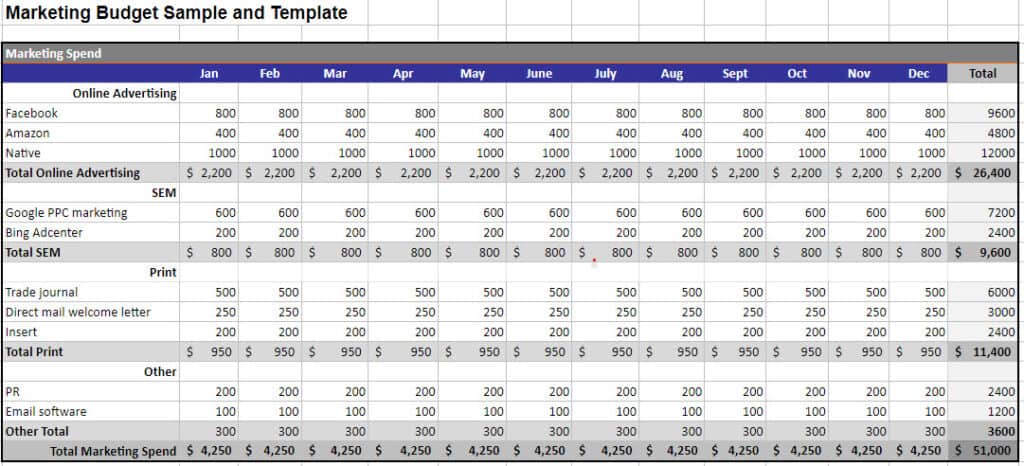

In this brief tutorial we explore why budgeting is important to a business and provide a plan you can use.

Budgeting is important to a business because it gives you information on the current available capital, estimates future expenses, and predicts incoming revenue. A budget helps you to focus on cash flow, reduce expenses, and set targets for profits and ROI.

Daily running of the business is rarely easy, and you may become preoccupied with reactivating to issues that come up, losing sight of the strategic plan. In contrast, successful businesses create and follow a budget, and set aside time for planning, forecast sales and production, monitor business performance and review the general financial situation.

Let’s now get into the details and help you set up your budget.

A budget gives you information on the current available capital, estimates future expenditure, and predicts incoming revenue.

A budget helps you weigh the expenditure against the available resources and allocate enough resources for initiatives promoting business growth and development. It allows you to focus on cash flow, lower expenditure, and improve profits and ROI.

Budgeting is key to business success since you can plan and control the finances. The absence of a budget means uncontrolled spending, making it harder to achieve business objectives.

In summary, a budget allows you to:

Here are five simple steps to help you craft a business budget;

Revenue means the total amount of money the business received in a certain period before expenses are deducted. You can begin simply totaling your expected total revenue for the period you are setting your budget for. Add the money from the various revenue sources to see what the business brings in.

Identify your monthly income, preferably for the previous 12 months, so that you have enough data to decide. A year's worth of information allows you to identify seasonal patterns and monthly income changes. Keeping two years data is best to find trends.

Subtract fixed costs from the total revenue. Fixed costs mean recurring expenditures necessary for running business operations daily, weekly, monthly, and even annually. Examples include;

These are general examples, and fixed costs are unique to individual businesses. Identify your business's total recurring expenditure and subtract the amount from total revenue.

You need to calculate your variable expenses. But don't get caught too deep in the weeds. The accountant can do that. You just need a general idea of your variable costs with each transaction. Variable expenses are dynamic, meaning they change with every transaction.

Other examples include but are not limited to:

They are called variable expenses because they change based on transactions. For example, if you sell 100 units to 100 customers in a month, your cost of goods sold (COGS) and transaction fees will be different than if you sold 1,000 units to 800 customers in a month.

Emergencies come when least expected. For instance, when processing a last-minute order, the car may stall on your way to an important business meeting or machines break down. Your budget needs to factor in such costs to avoid getting stranded during emergencies or times when you simply need to cover some unplanned for cash expenses. In a budget line-item you can simply call this petty cash under the Misc category.

Statement of profit and loss brings anxiety to some people, but it's not that difficult. Everything you have done so far is collecting the relevant information. It's now time to put the data together. You are already done with the difficult part.

Add up all the revenue for the selected period and also add up the expenses to end up with two figures. Keep this simple. Your accountant’s job is to focus on perfection.

Subtract total expenses from total income and hope you get a positive figure. A positive figure means profit, while a negative one indicates a loss. Project the findings in the next budget while making the relevant adjustment.

Making a budget is that simple!

Go here to download a free budget template

A budget is a tool that gives you control over your business' finances, enabling you to allocate funds accordingly. The budgeting process does not have to bury you in minutiae, it just needs to be good enough to give you a roadmap of your available resources tied to your strategic plan.

As you develop your budget, you need to focus on developing a solid tool that lets you see what you are working with, while your accounting staff focuses on perfecting the actual results. Use the actual results your accounting team gives you each month, each quarter and each year to establish your budget for the upcoming term.

References