What does USMCA stand for, and what is its purpose? (NAFTA 2.0)

If you have ever wondered what the USMCA is, and why it exists, you have come to the right place. […]

Read More »Become a successful marketing consultant: Learn more

Nothing is more exciting than funding a marketing campaign that has the ability to create new growth in customers and sales!

In this brief tutorial you are going to learn exactly how to do that. That is, how to fund your marketing campaign.

You fund a marketing campaign by 1) Getting clear on your objective, 2) Creating a budget and 3) Defining precisely how much capital you need in order to execute your marketing campaign. Once you know exactly how much you need, you can allocate future revenue based on sales to fund your marketing campaign, you can enlist your accounting team to find the funds, or ask your CEO and or your board of directors who will be happy to find the funding your marketing needs.

Marketing is like hitting a moving target.

You need to know who your customers are, what they want, and how much they'll pay for your product or service. This isn’t always easy. And it’s constantly changing.

But by getting clear on how you are funding your marketing, you can keep your marketing campaigns regularly running and constantly bringing in new sales and customers -- the ultimate plan for business growth.

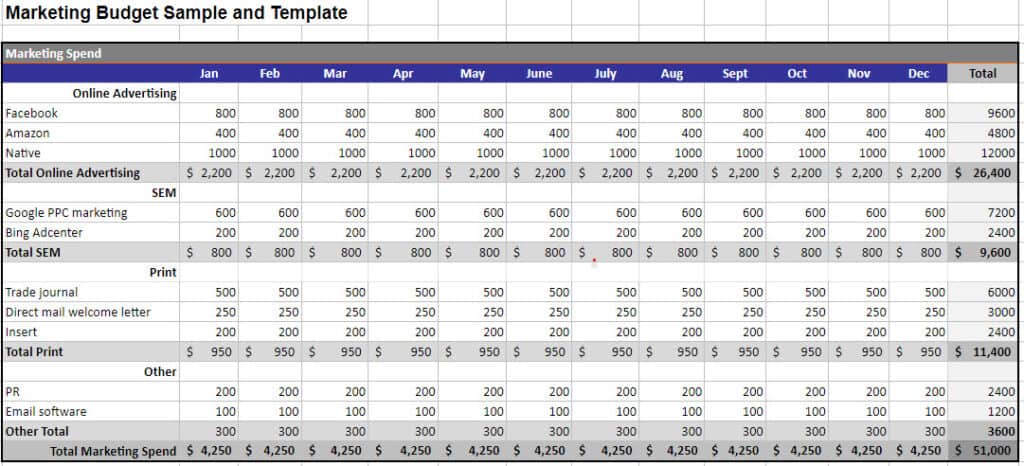

A budget is your first step to getting your marketing campaign in order.

In fact, realized or not, every company has a budget. Some are proactive and use it to their advantage, while others give a pile of receipts to their accountant at the end of the year.

Whether you are a single-member LLC or have a large marketing department, your budget operates like a rudder in a ship -- helping you to control the direction of your organization based on the resources you have available. Your marketing budget works in union with your marketing strategy, your marketing plan, your 4 P’s of marketing and your marketing calendar.

If you don’t have all these components developed yet, that’s ok. Just get started with your budget and figure out how you are going to allocate the money you need.

For a full tutorial on getting your budget started, go here:

Marketing Department Budget Sample and Template PDF (Free)

The money you need for your marketing campaign depends on what you want to achieve. This is why it is important to have a vision and a strategy.

Marketing strategy is important because it clarifies the reality of where you are now and the vision for where you want to be in the future. Your marketing strategy provides the actions for the vision of your organization.

And this marketing strategy is intimately tied to your budget, because how you structure your budget is the literal framework for your marketing strategy.

So, to get started, take a look at your most important business metrics, set some Key Performance Indicators (KPIs) in your marketing, and review your 4 P’s of Marketing, a.k.a., your Marketing Mix. Once you have these items organized, you’ll be able to begin to have a clearer idea of where your marketing money needs to go.

Nos is the time you will be thinking about how to best allocate marketing funds toward each component of your marketing strategy: advertising, search engine marketing, direct mail, content creation, social media management, etc.

This doesn’t have to be perfect, it just has to be good enough. And you will base these numbers on past performance.

If you don’t have any past performance to draw from, you have to simply get started. Make your decisions based on how much it will cost to acquire 1 customer. Then build your plan from that.

Ok, now the fun part.

Let’s define exactly how much money you need.

Take the total from your marketing budget and that is the number you are going to give to your team.

Once you've established your marketing plan and campaign(s), it's time to source the funds.

If your business is owned by another entity, such as a private equity firm, corporation or partnership, you may need to develop a presentation for the board of directors. In this case, you will need even more support from your CEO and accounting team.

Regardless of the situation, start with your accounting team. If it’s just you, go to your accountant and ask, “Here is my proposed marketing budget, how does this look based on my sales and future sales?”

Let him or her help you decide the best way forward.

If you need external capital, your financial team will help you prepare.

We don’t usually suggest financing your marketing campaigns for growth. If you have to finance a marketing campaign this may suggest something is wrong with your business model and or your capital structure or something else.

If this is the case, you need to go back to basics and start re-testing your selling propositions and figure out how to acquire one customer at a profit.

If this is the case, study these three brief tutorials and start testing your marketing campaigns:

Ok, with that, assuming you have all the bugs worked out and you still need to finance your marketing campaign, there are many ways to do it.

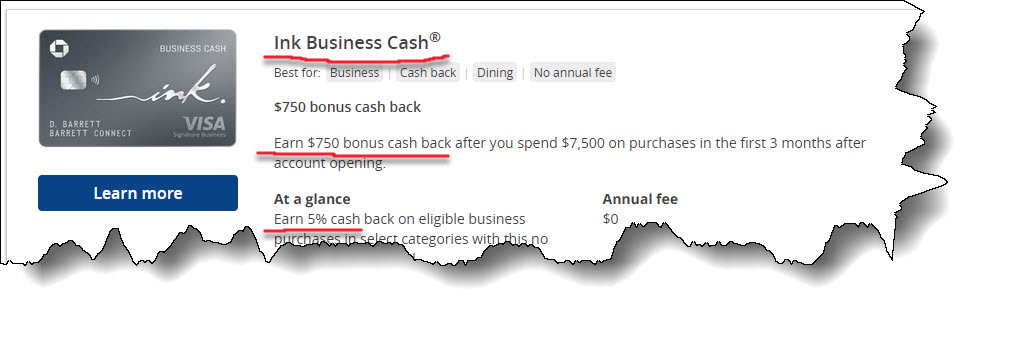

You can start with your bank. Most banks will provide a line of credit if you have a history of sales and cash flow.

They can also offer credit cards and other loan products. The main risk here is the interest rate, and in this current environment interest rates are rising.

For more information on financing a marketing campaign, go here: How Do You Finance a Marketing Campaign for Business Growth? (7 ways).

Bootstrapping a marketing campaign usually means simply figuring it out as you go.

If this is the case, you might consider a strong foundation of Guerrilla marketing and Referral marketing as your core marketing strategies. For more information on these two strategies go here:

Here’s a couple ways many new businesses bootstrap their way to fund their marketing campaign:

Bootstrapping with personal credit card debt. This is an easy way to get started and get some data for your marketing campaign without spending too much money upfront. But it's not without risk—if you're not careful about how much credit card debt you take, it can quickly spiral out of control. We prefer the Ink Business Credit Card by Chase as the points do rack up pretty quick, and they have good spending categories.

Bootstrapping with personal savings or investments. If you have the extra money in the bank or a retirement account, consider using those funds as capital for your business instead of going into debt or getting investors involved immediately. Remember that there are rules related to withdrawing certain types of retirement accounts; read up on them before jumping into this option!

Bootstrapping with love money. Love money is funding your marketing campaign with money from family and friends. Very often, a successful business sprouts from $5,000 from Mom, $10,000 from Dad, or $20,000 from the grandparents. Thai is very common, and may be a source of funds for your business.

So, to wrap up, a marketing budget is a key to success in any marketing campaign. And regardless of how you fund a marketing campaign, the core is your marketing budget.

If you don't plan and allocate your spending and customer acquisition, it can be easy to find yourself without funds too early in the process, possibly being forced to use more expensive options for needed capital.